What if we told you that every time you make a donation to a charity, you can add 25% on top of it at no cost to you?

If you’re thinking “is this some sort of charity ponzi scheme?”, sorry, no, you’re wrong. If you’re thinking “ are you talking about Gift Aid?”, then yes, you are very much correct.

What actually is Gift Aid?

Gift Aid is a UK Government scheme that allows any UK taxpayer who donates to charity to add 25% to their donation at no cost to them.

This is because the 25% is added by the government.

That means if you donate £10 and choose to add Gift Aid, your charity will receive an extra £2.50, taking the total donation amount to £12.50.

How do I add Gift Aid?

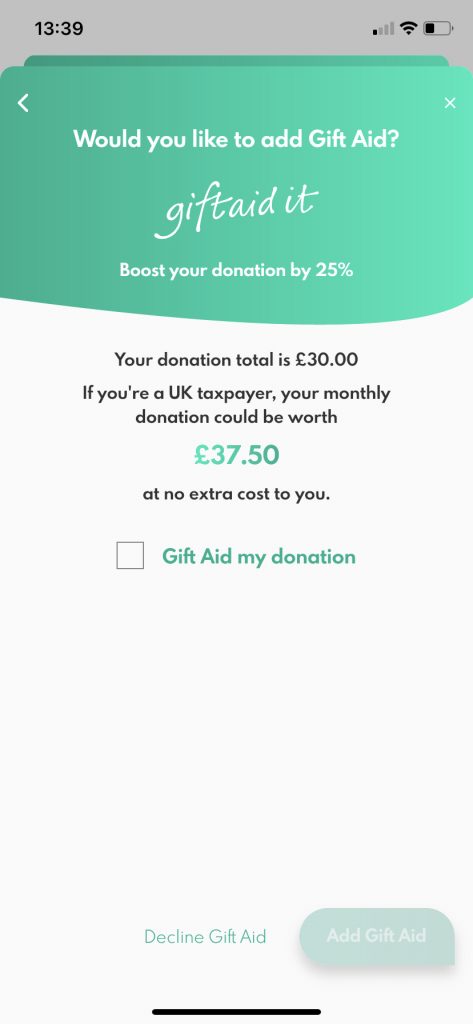

If you’re using Toucan, you just tap the box that says ‘Gift Aid my donation’.

Can anyone add Gift Aid?

Not quite. You can add Gift Aid as long as:

- you’re a UK taxpayer – specifically income or capital gains tax.

- you pay at least as much tax as your charities will claim back. So if you’re donating £100, you need to have paid at least £25 in tax that year.

Where does the 25% come from?

This gets a little complicated so bear with us.

Gift Aid is tax that’s claimed back by charities because your donation is viewed as a gift by the government and is therefore taxable.

For a basic-rate taxpayer (the basic rate is 20%), this adds up 25% of the donation. So if you donate £10 to charity, it’s treated as a gift that has been made after tax has been deducted at the basic rate tax, so the total value of the gift would be £12.50.

Charities can then claim this 20% of the basic rate tax back on your donation (£12.50 x 20% = £2.50).

It can get a bit headache-inducing so best to think of it like this:

Your charities can get 25% more money to do all sorts of wonderful things if you tick the Gift Aid box so you should tick it.

What if I’m in a higher tax bracket?

Well first off: Hello, big spender.

Secondly: You can claim back the difference between the tax rate you pay, and the basic rate on your donation. For example, as a higher-rate taxpayer, you’ll pay 40% tax.

If you’re using Toucan (if you’re not, hello again, big spender, download it here), you can export your donation history to submit to HMRC.